每檔基金MACD線圖新增「DIF - MACD 的值做成曲線」

每檔基金MACD線圖新增「DIF - MACD 的值做成曲線」

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

經過一番努力,這條「DIF - MACD 的值做成曲線」終於上線了,希望能在這個波動的行情中,幫各位大大找到進場時機。

感謝各位的協助,尤其是提供建議的Jerry大!

PS. 以下是大大提供的技術分析指南,供各位參考:

1. 藍線由下往上穿越零軸就是黃金交叉(在此同時,DIF向上穿越MACD)。

2. 藍線由上往下穿越零軸就是死亡交叉(在此同時,DIF向下穿越MACD)。

3. 藍線與零軸相交之點就是DIF與MACD相交之時。

Edward

基金的 移動平均線圖 指數平滑異同移動平均線圖 (MACD) 河流圖

若是做成 周 與 月 的圖示 ,是否可以愈來判斷趨勢呢??

另外 不知道若是在圖表上加上 垂直線 的背景底線 來顯示是日期對應上去的位置 ,不知道是否可行?

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

很好奇,E大的想法是什麼?

我想了一下,是不是想說時間拉長到周跟月,讓線圖反應不要如此劇烈,買賣點訊號變少,但相對也更準確?更適合做單筆加碼的判斷工具?

如果不慎揣摩錯了上意,還請指正。

luslus

E大的意思和K線圖看周K線和月K線的意思是一樣的

1.如果能看到周或月的指標,將更能掌握較中長期的趨勢;

2.每個圖表上加上垂直線的背景底線,來顯示每日對應上去的數值

也更能精準對應出每天指標值的變化..

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

垂直線對應日期可以先做,這幾天就會上。為兼顧簡潔,會以周為單位劃線,應該就能判斷線圖對應的日期。

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

最近市場波動大,沒啥好看,正是進行基礎建設的好時機。

希望圖弄好後,市場回歸正軌,大家開始享受投資樂趣。

king

king

自己很幸運能來到這裡

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

我們會再研究看看加入周跟月的線圖的可能性,如果各位大大有其他想法,請隨時跟我們說。

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

繪圖邏輯是把MACD用過去一個月(20日)的平均值呈現,得到一條平滑的曲線。

從過去半年的經驗來看,部分基金可以抓到今年三月左右出現的波段低點,例如用DIF-MACD_M穿過零,DIF_M又與MACD_M在零以下形成黃金交叉時,之後很多基金都走了一個波段,有興趣者可自行觀察。

希望此圖可以更有把握的抓到底部買點,幫助單筆投資人掌握進場時機。

genki109

另外,依您的解說~~小弟觀察似乎資源類的線圖在5/25之後都有穿過0軸,在零以下金叉的趨勢~~所以該快出手了嗎?!!

最後,能否順道請教,關於油的標的:天達跟施羅德,小弟觀察近期都是天達績效佳,不知您比較推薦的施羅德有何優勢?而這兩者哪個上游的比重較大?可以指導到哪兒查此細節嗎?非常感謝!

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

Investment success doesn't come from "buying good things",

but rather from "buying things well"

(投資成功不是因為買到好東西,而是因為「買得好」。)

~by Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor

強大

如你所說,從線型來看確實如此.我們也在觀察資源類基金,應該近期買點會浮現,年底前希望會有個波段,而非一直震盪.

選施羅德是它長期績效較天達好,記得近期也比天達好,今天落後應該不準,因為天達績效晚一天.

我只記得施羅德是上中下游都有投資,主要以大型綜合石油公司為主.天達不清楚,希望有其他大大可以解釋.

標榜重押上游的產品,比較有名的有摩根天然資源跟德盛旗下資源類產品.

熱門主題

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

經典話題

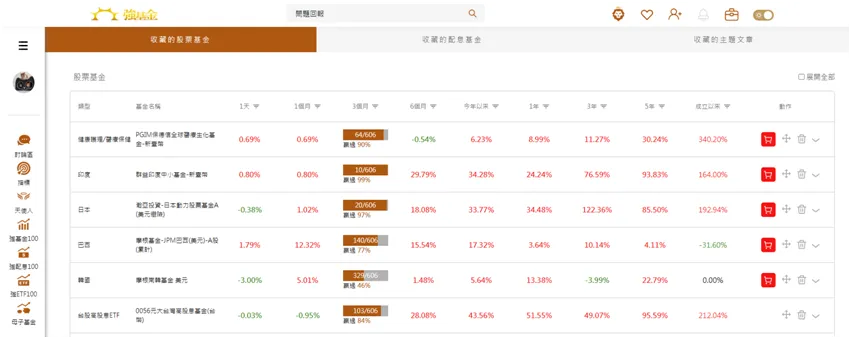

「我的收藏」全新上線,基金ETF收藏量最多150支

費半指數的線型剛完成底部型態,有機會再創新高

摩根士丹利美國增長基金淨值越過前波高點,繼續往上

強基金新版上線,請務必立刻清除快取,才能享受最佳瀏覽體驗

台股主動基金長線擊敗被動高股息ETF的3張藏金圖

基金更新成份股持股的每月公布時間

收藏基金新版面看不到基金的最新淨值